If you take a look at your credit card, the first four or six digits that you see is known as Bank Identification number. The initial four or six digits of any credit card will be the BIN number, and with the help of BIN checker tool, you can get a lot of information.

If you want to get a BIN database, you get to check out www.freebinchecker.com for essential details and information. You will find more than 800,000 records, and the site updates its record every few hours so that the clients can remain updated with the records.

Understanding BIN

The IIN number, which is issued to your bank, which is known as Issuer Identification Number, is also sometimes known as the BIN number, which is Bank Identification Number. Therefore, if someone refers to BIN or IIN, they are referring to the same thing. By far, you must have understood that it is the first four or six digits. With this BIN number, BIN Checker App can help you find all the details of the customer without a problem.

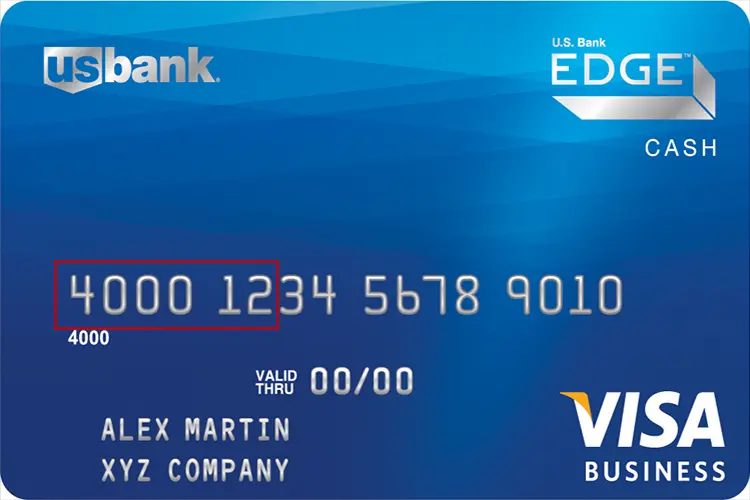

If you are still struggling to find the BIN number of your credit card number, take a look at the image above. We have highlighted the number, which is the BIN number. The BIN number is not the all 16-digit number, though. It is not valid through number, and not the CVV number, which is there in the back. It is only the first four or the first six digits.

Just like any other industry, even your credit card has undecipherable acronyms which are used for a different purpose, and unfortunately, the BIN number is just the same. The main purpose of why someone might be interested in BIN Lookup Tool is to find which bank the card belongs to, and what type of institution it is. Basically, any bank that issues you a credit card will have a unique BIN as well.

If someone is using an electronic card, prepaid cards, debit, and even credit cards, every card will have a dedicated BIN number. However, more and more institutions are using the IIN term, or the Issuer Identification number as BIN. Many companies ask for BIN details to serve different purposes. But whether its IIN or BIN, the meaning is the same, and can be used interchangeably.

In both of the cases, you will notice that some banks offer four digits BIN number, while the other six digital. The bank your card is associated with will be able to tell you what the BIN number is, whether it is 6 or 8. However, most of the institutions issue a 6-digit BIN number, but it’s not mandatory.

The principal digit of the card number is the Major Industry Identifier or MII, and it has specific importance all alone. The MII recognizes the class or kind of foundation which gave the card. Visa-and MasterCard-marked cards, for instance, are basically given by banks. Thus they are named money related payment cards. Burger joint’s Club and American Express are viewed as movement and amusement cards, as this was their essential capacity at the time they appeared.

Benefits of BIN

There can be a few merchants who require the BIN number to take out information of their customers or clients. This is often done by the online transaction merchants where you swipe or pay through online mode. Here are some of the reasons why someone might use a BIN Checker App:

To get information like name, address, and phone number

Whenever you swipe your card or do on an online transaction, you will enter your card details. The BIN number can be used to get some vital information from the customers, for example, their name, address, and also the phone number. These details could be important for the merchant to do the transaction so that in case of fraud, the merchant can take legitimate action.

The card brands

Some of the merchants may require the BIN number to find out small details like the card brands. Meaning, the merchant might want to know whether the card that has been used is a Mastercard, American Express card and so on.

The type of card

The third reason why someone might want to know the BIN number is to get information like the type of card that has been used to do the transaction, such as debit card, electronic card, prepaid card, credit card, and so on. Some companies require this information.

The level of card

This is rather a simple reason, by the level of the card, we simply mean a card which will be either of business, platinum, or black card. With this card, the merchant gets to know the level of the card, and likewise, probably pitch a few better products and more.

Other details which can be chucked out from the BIN number is which country does the card has been used from (whatever the card is). This is especially vital information to know if the customer who is doing or has done the transaction is an international customer.

The last reason and one of the most important reasons why BIN tracking can be done is whether the information that you have provided matches the card details or not. Many people fake their address, in particular; however, with BIN, you don’t have to worry about doing a background check for address. You will have all the information at hand.

The future is shifting to digital reality, and more and more merchants will need the BIN information of the customers, to be sure that the transaction is valid. We are pretty sure that by default BIN number will be required by merchants pretty soon. BIN gives all the information quickly, and therefore it becomes very important. With so many account numbers and details available, there must be a tool, which will quickly let you find all the details of the customer that is required.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024