A credit card for many people is a ‘plastic of luxury’, after all, they make life easy with just a simple swipe, but multiple careless swipes can also make your life difficult. Managing your credit card expenditure and sticking to a realistic budget is a trick one must learn well. Now, if reading ‘credit card’ and ‘budget’ together in the same line seems confusing and new at the same time, this will definitely be a good read for you.

The trick here is to make it work in your favor instead of the other way around. To make this happen, it is crucial to understand how credit cards work well with budgeting.

How credit card works hand in hand with budgeting?

- Credit cards help in keeping track of all expenses, big or small, which is key when it comes to budgeting. Keeping an eye out on expenses can also give a clear picture of where the money is going every month

- The additional 30 days every month act as a buffer while paying for expenses and managing cash flow. This prudent handling of cash brings a perfect balance between income and expenses

- Another great reason to use credit cards while sticking to a budget is convenience. Overseeing expenses made in petty cash can prove to be extremely troublesome, whereas supervising credit card transactions is easy and less time-consuming. If the money is lost, it can make a big dent in a well-estimated budget plan but if the credit card is lost it can easily be blocked and the budget stays safe

Now that we know how to put both of them together, let’s look at a few budgeting strategies that are cost-saving and super-efficient

- Planned vs. actual: From personal budget plans to professional business budgets, this technique is world-famous. In this budget, the two columns that must be managed each month are expected expenses and actual expenses. Correlating these two columns highlights the problem areas either in estimation or in expense, making this iterative process much more efficient every month

- Zero-sum strategy: This strategy is very simple, every month pay off the expenses with the previous month’s income while also conserving cash for future emergencies. While freshly starting out this plan, it is recommended to estimate your expenses and spend parsimoniously

With these strategies in place, it is now easier to lay the foundation with these 5 simple steps and build a comprehensive budget plan with credit cards.

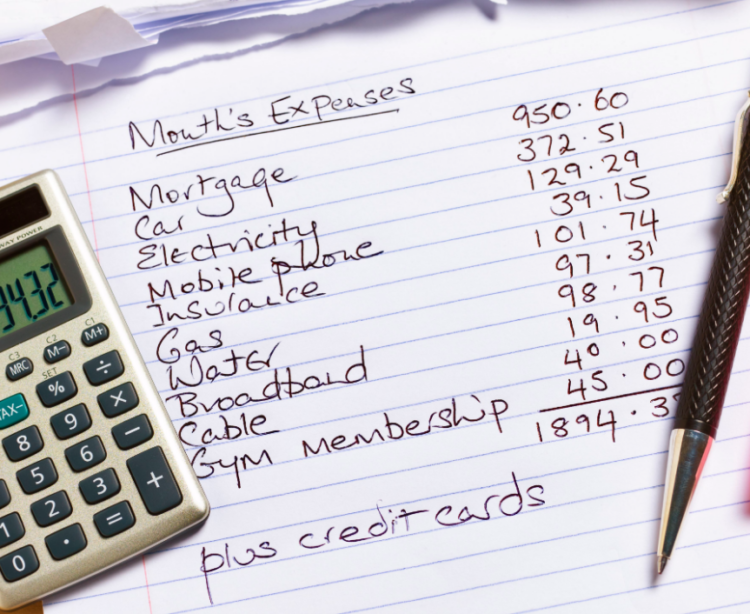

1. Create an all-inclusive list of expenses

Whether using a credit card or not, it is always beneficial to pen down all the expenses. Once listed, it is easier to forecast the amount due by the end of the month.

Give priority to the essential and known monthly expenses like rent, EMI, food, maintenance, etc. After this, all the non-essential expenses can follow through with the smallest of expenses.

This is where credit card plays its role, this amount can easily be paid by using it. It also helps to check back if any previous payments are overdue and must be tackled before the new ones pile up.

2. Cross-check the sum total against income

Once the comprehensive list is created, it is vital to touch base and check if the expenses are more or less? The latter is a rare sight.

If the outflow is more than the income, figure out which unimportant entry can be eliminated. Not cutting out these loose ends can pile up into debt by the end of the month.

Use the credit card wisely to deal with the urgent and important spendings first and restrict using it for unnecessary expenses. After all, prevention is better than cure.

3. Categorize spends and lookout for ways to optimize

Everyone is always looking for ways to cut down on their spending and save more. Isn’t that exactly the reason for reading this?

Bifurcate expenses in realistic categories and check if the money allocated to each category can be reduced or redistributed. Revisiting past month’s expenses can help in practically allocating and redistributing to fundamental categories.

4. Keep a check on the actual expenditure

Constantly track the money spent in each category and remember to stick to these constraints if the budget is really close to the upper limit set.

It is also advisable to pay the amount due every 15 days to stay on track with the plan. This will give a fair idea of how much money is spent or left.

5. Start fresh each month with an enhanced budget

Look back to last month’s plan and revamp the new month’s plan with these findings. Each fresh month, the credit card experience gets better and more efficient, making you forget cash and debit cards.

If the past month’s expenditure went above the planned budget, make sure to adjust the next month’s plan and focus entirely on essentials to stay within budget.

Credit cards and budgeting are like two sides of the same coin. If used wisely, a credit card can help you manage your money while also saving up on the side. Make it a point to use the power of credit card efficiently with your monthly budget because with great power comes great responsibility.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024