When you start a new business, you maintain a positive outlook, hoping that nothing would go wrong. However, risks start from the day you open your shop and if not taken care of are going to make you lose a great deal of money.

There can be any form of exigency that may affect your business and that is where insuring your business proves useful.

Here we tell you 7 Types of business insurance that you use to keep it safe:

1. Professional Liability Insurance

Professional Liability insurance will provide you with ample coverage if you have incurred any losses due to your carelessness. This type of coverage is also known as errors and omissions coverage. In this category fall mistakes that have happened due to your business not performing or any other misfortune that may have affected you.

Each kind of business can have separate sorts of errors falling under this category and it depends upon the market you are operating in.

2. Property insurance

Whether you have a leased property or your own, you need property insurance. This type would cover any signage, furniture, inventory and equipment that you have maintained in the office. If any of these get destroyed or damaged due to fire, storm or any other calamity, you can expect to get the returns for the same.

However, if there has been mass destruction to a calamity like earthquakes and floods, then you may not be approved for the payment. In case your area is prone to the same, you would have to consult the insurance provider to let you know about any other alternative.

3. Worker’s compensation insurance

As soon as you hire your first employee, you must get a worker’s compensation insurance. If your employee suffers any injury or even death while he is at the workplace, his immediate family can claim the payment for the loss.

Medical treatment, disability benefits, and death benefits are all covered under this insurance. Even if the employee is handling a low-risk job there are chances of him having mishaps at work and hence having this coverage is advised.

4. Product liability insurance

In case your business is creating products to be sold in the market, the product liability coverage must be undertaken. You may take ample steps to take care that your products do not harm anyone in the long run.

But, as they say, anything can happen in business and it is required that you are open to any of your products being sued for something that you had not anticipated. However, in this type of insurance, the coverage is specifically targeted towards a particular type of product.

5. Vehicle insurance

At times, vehicles are used to transfer products and services to places where customers buy them. You would have to see that all your vehicles are insured in case there is an accident while moving around. Businesses should ensure their vehicles against any third party injuries.

However, if you take comprehensive insurance that would also cover the following items. In case employees use their vehicles for transport, they may also be covered under the same. If products are being delivered for certain fees that may not be included in this section.

6. Business interruption insurance

If any type of disaster strikes your business, it would not be able to perform as per its ability. The employees would be stalled and the output will fall. This kind of insurance is suitable only for businesses that are location-dependent, for example, retail stores of any kind.

Any loss of income that you may face during this time because of your business getting interrupted would be covered and the payment for the loss provided.

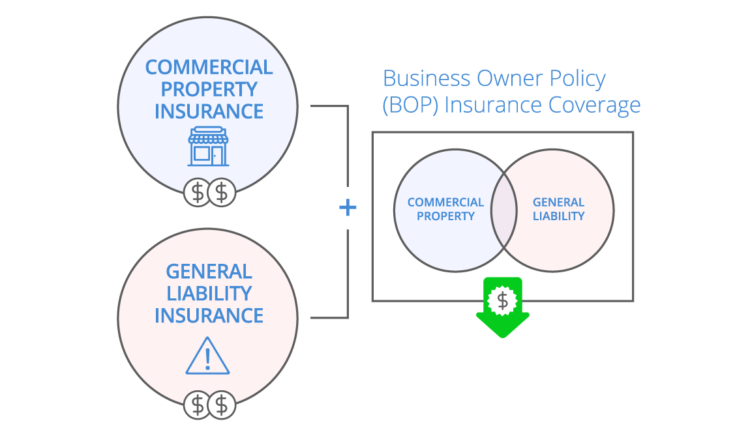

7. Business owner’s policy (BOP)

This is the complete package often taken in case you are wary of anything wrong to happen. It includes business interruption, vehicle coverage, property, liability, and crime insurance as well.

You can always choose which all items you would want to include under the Business owner’s policy. A business owner can save money by opting for the full package instead of choosing individual policies which obviously cost more.

Benefits of a Business Insurance

- Risk management– Coverage any kind of risks that arise during the business operating times.

- Third-party liability– If unknowingly the business harms any other party with its product or service that would be covered too.

- Safety from natural hazards– In case a natural hazard damages your business; you may claim the money of the loss.

- The lawsuit– Sometimes companies have to face lawsuits because of a product getting wrong. All the expenses that are incurred can be collected with business insurance.

- Copyright security– If your product is copyrighted under your name and someone else wants to steal the same, you can get the same covered under business insurance. Click here to know more about business coverage and how you can choose one correctly.

Inclusions

- Loss due to any financial crisis in the company

- Any losses because a theft happened in the business

- Employee death or injury that he incurs when he is working for you

- Losses due to any natural hazards and fire

- Third-party liability allowance is given as part of your business

Exclusions

- Nuclear hazard and depreciation

- Electricity and power loss

- If the government takes any action against a cause

- Any illegal activities that are undertaken by the business on its part

- Extensions and reductions made to the business property

Conclusion

Having a business and trying to make it successful is as it is a tough job. Plus, the risk of losing all your money because of any mishap always exists. You must choose the right company to help you pick the most suitable business insurance policy for you.

Once your policy is in place you can relax as even if there are any issues you can hope to recover. But, remember to understand the terms of each policy in advance so that when the situation of taking a claim arises, your work happens smoothly.

Mostly many aspects of risk are covered in the insurance policy but try and avoid those incidents from happening which are not.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024