When it comes to merging the world of finances and technology, the outcome is something called fintech.

Fintech focuses on enriching financial services through the advancements of technology, and it is a heavily focused field in today’s time.

Currently, the total value of fintech is around $310 billion, through an annual rate of around 25%. Judging by this, the value of this industry could rise up to a trillion dollars in no longer than a few years.

The money involved is a stepping stone for companies to perfect their services since the key factor is to eliminate fees and make paying easily accessible.

So, to shed some light on what this means, we are going to talk about the fintech trends. Do try and take note of the trends we’ll be mentioning since they concern everyone and everything that involved money.

1. AI, Big Data, and Personalization

Living in the information era does come with a few benefits for everyone. One of the key benefits includes harnessing big data and transferring it in the form of personalization.

What this means is that everything we do online, every click, every like, every subscribe, every Google search, everything translates into data which companies can use to personalize the experience of their customers.

A greater emphasis is put on personalization nowadays, with it being the biggest driving factor to a businesses’ success.

To make the most of out it, companies integrate their big data algorithms through AI. AI, as we all know, has the potential to make or break our society. Those that advocate against its usage does make solid points, but we’re not using AI for major services in our lives.

AI can be used in the fintech industry to help automate the data process and deliver successful results to each customer based on their experiences and likings online.

This has a significant chance of altering a person’s experience to make him a lifelong customer.

2. RPA – Robotic Process Automation

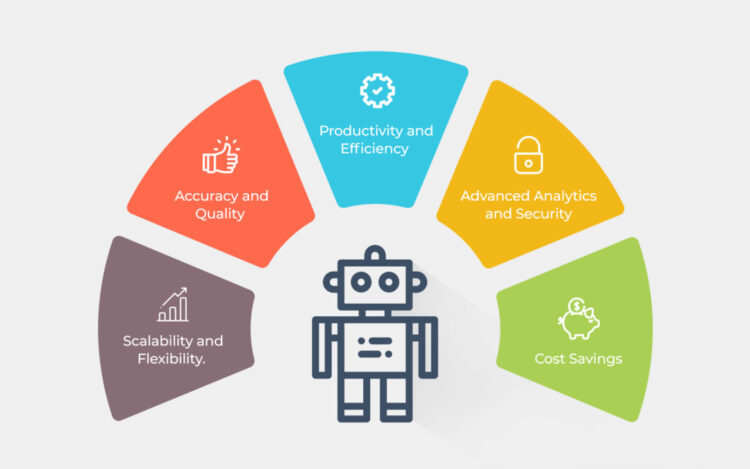

Yet another trend that involves using Artificial Intelligence, RPA is a process of automation that takes the backseat, instead of the drivers.

RPA uses AI to observe our behaviors and suggest strategies to improve each process. As you’d expect, RPA is heavily used in fintech, and it is an excellent way to make the industry more efficient and more effective.

RPA observes nearly every administrative task and activity imaginable and delivers reports on how to make the entire process more effective and efficient. RPA does a thankless job that most people aren’t even aware it exists and will be an even bigger trend.

3. Chatbots to Perfect Automation

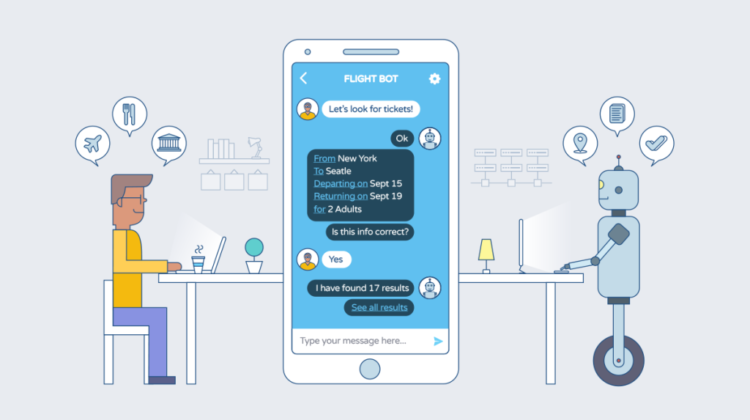

Currently, there is much talk on the subject of chatbots for businesses, banks, and big corporations. Chatbots, for those that don’t know, are messages that pop up every time you visit a website.

Although some are different than others, they are mainly used to eliminate human interaction. According to Eyal Nachum, a senior executive at Bruc Bond, chatbots will be used in nearly 87% of banks and businesses by 2024. This, naturally, means that their usage is currently unprecedented, and it is a trend your business must hop onto.

But why it is that a simple robot messaging is so useful for these establishments? Well, on average, chatbots help customers save almost four minutes. This means that every time you have to speak to someone at the bank or at a business, you won’t have to wait long lines only for them to answer a simple question.

Chatbots are designed to provide customers with answers to some very industry-specific questions and FAQs. Others, however, are capable of delivering source material for the customer’s needs, and some will be so advanced that you can even have a conversation with them.

But the bottom line of using chatbots is that they’re there to help customers save a lot of time.

4. Blockchain

Few people can disregard the usage of Blockchain in modern time banking. It is the primary usage of this decentralized and distributed space to eliminate financial fraud, eliminate fees, and make every payment more efficient.

And while there are many more usages out there, these few can be greatly applied to every financial institution.

As mentioned, Blockchain has the potential to make every payment lighting fast. What this means is that banks and financial institutions can use the Blockchain technology to transfer large sums of money virtually anywhere around the globe in mere minutes. This process would otherwise take days to complete.

Another benefit of using the Blockchain is that it eliminates the huge fees every time you have to send money to someone. By using some of the currency available on the Blockchain such as Bitcoin, Litecoin, Monero, Dash, and probably the most important one, Ripple XRP, banks, institutions, and individuals can enjoy small fees with their payments.

Ripple XRP is probably the currency that is predicted to takes center stage with banks. As a matter of fact, Ripple has currently more than $145 billion transactions, which makes it the largest currency to be used in financial transactions. The Ripple payment protocol is more than capable of sending large sums, and the largest single transaction to this day includes $700 million!

Some of the global banking leaders that use Ripple XRP include Standard Charted, RBC, Axis, SBI, RakBank UAE, Santander, Deloitte, Accenture, UniCredit, UBS, and many more are predicted to follow.

5. Mobile Payment Systems and Innovations

Throughout the years we’ve seen a meteoric rise in the usage of smartphones. But not only that, nearly every service has a mobile app nowadays.

What this means is that you can access services straight from your smartphone. Nowadays, you can even pay for things using only your smartphone.

This is all made possible through mobile payment systems and innovations. Mobile payment is a huge player in fintech, and it accounts for a large portion of the industry’s growth.

Most popular mobile payment services include the likes of Apple, Google, Tencent and Alibaba, which all have their own mobile payment services, while others include WeChat Pay, PayPal, Payoneer, Square, Paydiant, and many more.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024