I’m sure you’ve heard about President Joe Biden’s plan to cancel as much as $10,000 of student debt. Like most people, you probably don’t know what to make of this idea.

If you are a recent graduate, or you are still in school now, you might be relieved to have some of that weight taken off your shoulders.

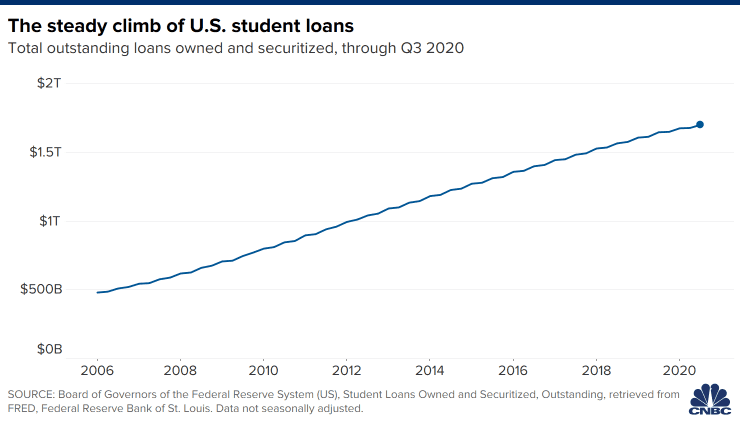

If you don’t have any student debt, you might be worried about the economic impact of forgiving trillions of dollars in debt on our economy. Some people think that $10,000 is too little to forgive, while others think it is way too much. Read more. In this article, we are going to cover the positive and the negative impacts that are about to come.

What Is the Plan?

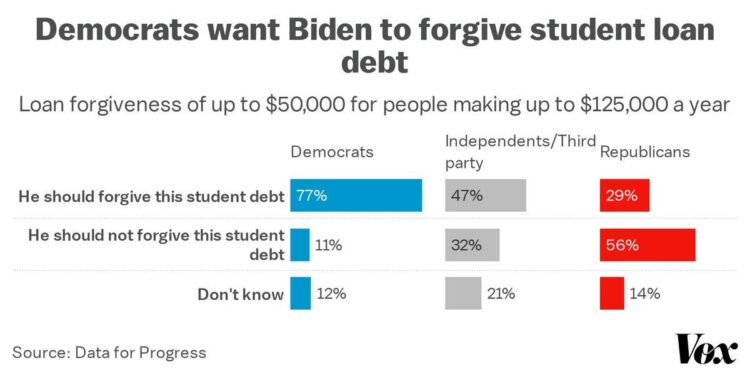

When it comes to student loan debt and what the President can do on his own, there are limitations. Some policies can be set by the Department of Education alone, while others would need to be approved by Congress. Since both Congressional chambers have a majority of Democratic officials, there is likely to be some change.

Before the election, Biden proposed some ideas for higher education reforms on his campaign website. Named “Joe’s Agenda for Students”, the proposal included multiple initiatives concerning the cost of college, including raising Pell Grants, decreasing payments for undergraduate federal loans, and expanding on loan forgiveness programs.

As soon as Biden entered office, he signed an executive action that allowed for the continuation of the delayed student loan payments enacted by the Trump administration. This extension will continue to leave the interest rate of student loans at 0% until September 20, 2024… More on this story here.

Biden also is expected to propose legislation to Congress that would provide $10,000 in student loan forgiveness to those who borrowed federal loans. Some Democrats think that this amount is not enough and have been trying to fight for a larger amount. Senator Bernie Sanders proposed the cancellation of all existing student debt.

Positive Impacts

While it is true that most borrowers of federal loans owe more than $10,000, any amount of loan forgiveness would benefit their financial situation. Economists believe that student loan forgiveness would serve as a stimulus to the economy because borrowers would have more money available for things like buying a house.

Student loan forgiveness could also benefit lower-income borrowers. This includes women and minorities. How student loan forgiveness works: https://www.debtfreeadventure.com/how-does-student-loan-forgiveness-work/. An academic paper recently stated that the median income for Black households would increase up to 42% with $75,000 in forgiveness and up to 34% with $50,000 in forgiveness.

Small Amounts Can Wipe Student Debt for Millions

Eliminating just $10,000 of student debt would help at least 15.3 million borrowers by completely getting rid of the balance of their student loans. This is about 33% of borrowers. It could also benefit 9.6 million people who owe anywhere between $20,000 and $40,000, which is the largest number of borrowers at 21.1%.

Potential Economy Boost

There was a study shared using data from 2016 that looks deeper into the effects that could be seen from student loan forgiveness. This study stated that canceling $1.4 trillion one-time could increase earnings by $86 to $108 billion on average each year.

Canceling this debt means that those monthly debt payments can go toward other spending or savings. The majority of people who make student loan payments typically pay between $200 and $300 per month, and loan forgiveness can free up that money to spend on other things.

Forgiveness could also help people who have been putting off some major milestones. In a survey of 1,000 Americans between the ages of 22 and 35, 61% have put off buying a house due to their student debt.

Most Will Benefit

One of the largest arguments about whether or not loan forgiveness is a good idea is that it would mainly help higher-income households that have a higher student loan debt. However, lower-income households will benefit as well. Most borrowers have a loan balance of less than $20,000. Larger balances are held by those with higher income. Those who will benefit most are people of color. Black students have a much heavier burden, as about 87% of Black students who attend a 4-year college will take out student loans, and only 60% of White students take out loans.

This bill is also good for those who have defaulted on their student loan payments. If student loans are forgiven, those who have defaulted on payments will see a boost in their credit score. It is estimated that 250,000 student loan borrowers default on their payments for the first time every quarter. Getting a loan removed from a credit report that has defaulted will raise a credit score almost instantly. However, it is not yet clear that if a defaulted loan will remain on the credit profile after the cancellation is completed.

Negative Impacts

There are critics out there who that argue the cancellation of student debt would only benefit college students and graduates.

There are over 40 million Americans that have some type of student loan debt, but that only makes up one-eighth of the total United States population.

Those who did not attend college and obtain any debt, as well as those who have already struggled to pay off their student debt might also object to this proposal. It is also important to keep in mind that the cancellation of current student debt does nothing about the high costs of a college education.

Little Spendable Cash

The point of an economic stimulus is to increase spending when the economy is at a weak point. Forgiving student loan debt won’t have a very large impact on what is available to spend immediately. If student loans were to be forgiven completely, it would cost the government $1.5 trillion. However, it would only free up about $90 billion per year of spendable cash. Some borrowers might notice that their credit score will go down when their student debt is canceled. That is because credit bureaus have one less payment to evaluate creditworthiness. This can result in less ability to open new credit accounts.

Poorly Targeted

Loan cancellation would not only provide a small amount of spendable cash, but the cash that it does provide would only benefit a select group of people. The stimulus money that is spent instead of saved will provide a stronger boost to the economy. Those who have a lower income are more likely to spend any additional money. It has also been proven that debt cancellation would likely go to those with higher incomes and those who have been able to maintain their income during the current economic crisis. The majority of people who have been affected by the crisis most likely have little or no student debt.

More than 70% of currently unemployed workers do not hold a bachelor’s degree, including 43% who didn’t attend college at all.

However, less than a third of student debt is held by households that do not have a bachelor’s degree. The total group of people with a college degree makes up less than one-tenth of the currently unemployed workers.

Conclusion

President Biden has announced that he will offer a proposal to cancel up to $10,000 of student debt for every American that currently has an outstanding loan balance. There is some debate on whether or not this will be a good economic decision. There are several positives as well as negatives that will come from student loan forgiveness. While student loan forgiveness will help the economy, it isn’t the best form of economic stimulus that we could be getting.

\There will be a longer impact than an immediate impact, which won’t do much good for people who need the money now. Getting rid of student debt, whether some or all, can free up some extra money for people every month.

With extra money available each month, borrowers can focus on paying other debts or making other purchases and putting money back into the economy.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024