Under section 80c of Income Tax Act taxpayers from all income tax slabs can avail the benefit of tax-saving through investing in ELSS (Equity-Linked Savings Scheme) also known as Tax Saver Funds. Through tax saver, mutual funds can save up to 46,800 INR by investing up to 1.5 Lac INR. These funds help investors build their wealth by giving high returns compared to other tax-saving schemes available in India such as Provident Fund (PF) and National Pension Scheme (NPS). Tax saver funds also have a very low lock-in period starting from 3 years, whereas an NPS can only be cashed out at the age of 60 and a Provident Fund matures after 15 years. You can also visit foreignusa.com to find out more about States Income Tax Rates.

Advantages of ELSS tax-saving funds:

- Lock-in period is 3 years, lowest compared to any other tax-saving scheme under section 80c

- Earnings are taxed as Long Term Capital Gains (LTCD) only at 10% once the gains cross the threshold of 1 lac per annum. If the gains are less than 1 lac, they are not taxable

- Very low minimum investment amounts (ranging from INR 500 to 5000)

- Returns are usually higher compared to PF and NPS

- Experienced fund managers

- Diversified portfolios for funds

- Flexibility in investing (SIPs and Lumpsum)

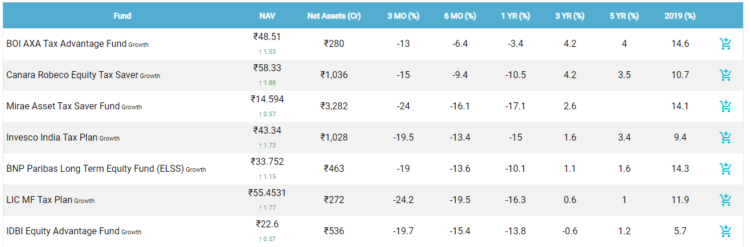

Top tax-saving funds. Source: newskart.com

Top 7 ELSS tax-saving funds under section 80c

There are several consistent performing tax-saver funds in the Indian market. We will be looking at the top 7 ELSS funds, listed below. The list also includes the Mirae Asset Tax Saver fund ranked at 3. Mirae Asset fund for tax saving is the only fund that started after 2015 to make this list.

The funds listed above have net assets ranging from 200 -5000 Crore INR, they also have managed investments for at least 3 years in the Indian market. NAV represents the Net Asset Value, the value of one mutual fund unit.

Top 7 ELSS tax-saving funds and their performance observed on 29 Feb 2024. Source: fincash.com

1. BOI AXA Tax Advantage Fund

BOI AXA Tax Advantage fund is managed by Mr. Aakash Manghani. Benchmark: S&P 500 TR India. Major holdings include HDFC Bank LTD, Abbott India LTD, Bajaj Finance LTD, Asian Paints LTD, and Kotak Mahindra Bank. The fund’s annual growth rate in the year 2019 is 14.6%

2. Canara Robeco Equity Tax Saver Fund

Canara Robeco Equity Tax Saver fund is managed by Shridatta Bandwaldar and Cheenu Gupta. Benchmark: S&P BSE 100 TR India. Major holdings include ICICI Bank Ltd, Reliance Industries, Infosys Ltd, Axis Bank Ltd, and Divi’s Laboratories Ltd. The fund’s annual growth rate in 2019 is 10.7%

3. Mirae Asset Tax Saver Fund

Mirae Asset Tax Saver fund (MATS fund) is Managed by Mr. Neelesh Surana. Benchmark: IISL Nifty 200 TR INR. Major holdings include HDFC Bank LTD, Reliance Industries, ICICI bank ltd, Axis Bank Ltd and State Bank of India. The fund’s annual growth rate in 2019 is 14.1%

4. Invesco India Tax Plan

Invesco India Tax Plan is managed by Amit Ganatra and Dhimant Kothari. Benchmark: S&P BSE 200 TR India. Major holdings include HDFC Bank Ltd, Reliance Industries, ICICI Bank Ltd, Housing Development, and Infosys Ltd. The fund’s annual growth rate in 2019 is 9.4%

5. BNP Paribas Long Term Equity Fund

The fund is managed by Abhijeet Dey and Karthikraj Laxmanan. BenchMark: IISL Nifty 200 TR INR. Major holdings include HDFC Bank LTD, ICICI Bank LTD, Infosys Ltd, Reliance Industries and Bharti Airtel Ltd. The fund’s annual growth rate in 2019 is 14.3%

6. LIC MF Tax Plan

LIC MF Tax Plan is managed by Mr. Sachin Relekar. Benchmark: IISL Nifty 500 TR INR. Major holdings include HDFC Bank LTD, ICICI Bank Ltd, Bajaj Finance Ltd, Infosys Ltd, and Avenue Supermarts. Fund’s annual growth rate in 2019 is 11.9%

7. IDBI Equity Advantage Fund

IDBI Equity Advantage fund is managed by Uma Venkataraman. Benchmark: S&P BSE 200 India TR INR. Major holdings include Pidilite Industries Ltd, Nestle India Ltd, Asian Paints Ltd, MRF Ltd, and Kotak Mahindra Bank. While the rest of the funds mentioned above invest majorly into financial services, the IDBI Equity fund invests in Consumer Cyclicals. The fund’s annual growth rate in 2019 is 5.7%

All the 7 funds listed above have a lot of similarities in terms of how they invest, all of them predominantly invest in equity and equity-related instruments. While no two portfolios are the same, most of these funds have shareholdings in HDFC Bank Ltd, ICICI Bank Ltd, and Reliance Industries; indicating that the consistency of performance depends on the portfolio. Mirae Asset Tax Saver fund is the fastest-growing fund among the top 7 funds with total Assets under Management (AUM) of 3282 Crore INR. These funds also have a very low minimum investment limit, making them the most viable option for tax-saving and building wealth. None of the mutual funds assure guaranteed returns, an investor needs to familiarize himself/herself with the market volatilities and risk before investing.

Hi Boox Popular Magazine 2024

Hi Boox Popular Magazine 2024